The crazy thing is much of Trump’s base benefit from these very Entitlement programs, but his base is not rich, and the rich needs this money!

It has been reported that the tax plan Republicans enacted will cost Americans $2.3 trillion. An astronomical cost dumped on our back with the sole purpose of giving more to the rich. So in their effort to justify this thievery, Republicans will cut entitlement programs that help the poor.

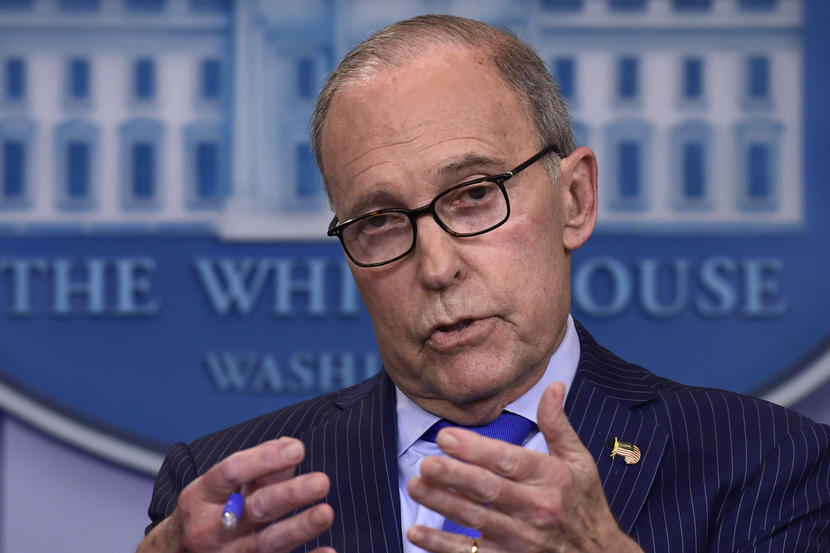

Today, for example, Larry Kudlow, the director of the Trump White House’s National Economic Council, spoke at the Economic Club of New York, and had this exchange with CNBC’s Becky Quick:

QUICK: Will the Trump administration tackle entitlement reform?

KUDLOW: Well, we’ve already tackled a big part of the newest entitlement, namely Obamacare. As far as the larger entitlements, I think everybody’s going to look at that probably next year. I don’t want to be specific, I don’t want to get ahead of our own budgeting, but we’ll get there.

Amazingly, his base is okay with losing their life-saving benefits if it means putting more money in Trump’s pocket. They are like sheep following the beloved wolf to their demise.