There are multiple reasons why the jobless claims data fall. The best reason however, is confidence in the economy, which leads to economic growth, which leads to fewer jobless claims being filed.

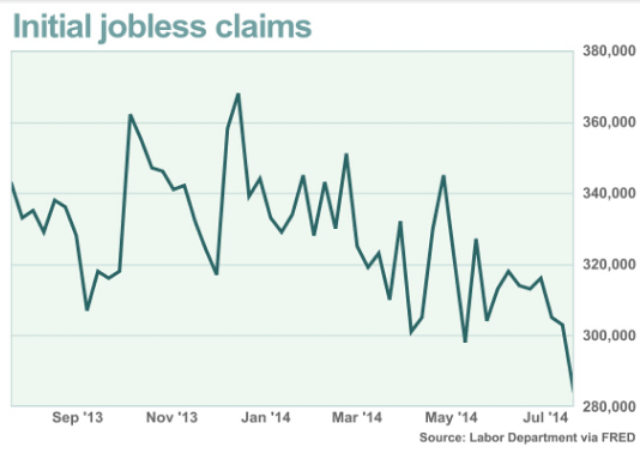

The number of unemployed workers applying for jobless benefits tumbled in the most recent weekly data to the lowest level in more than eight years, signaling that employers are letting go of very few workers.

Applicants for regular state unemployment-insurance benefits in the week that ended July 19 dropped by 19,000 to 284,000 — the lowest level since February 2006, the U.S. Labor Department reported Thursday. Economists surveyed by MarketWatch had expected initial claims of 310,000 in the most recent weekly data.

The yield on the 10-year Treasury 10_YEAR +1.98% edged higher, indicating traders growing slightly more confident in the economy.