Did you know that the Trump campaign has said he will NOT be releasing his taxes before the November presidential election?…

I love the way Yahoo News put this. They said if Trump had his way, his tax hike proposal would have…

One of the many specifics proposed by President Obama in this year's State of The Union Address was lowing the taxes…

And the Republicans rejoice. They have been working for this outcome for decades! Middle- and low-income Americans are facing far higher…

The Republican Leader of the House of Representatives thought he was on safe ground when he decided to write a post…

In this week's address, president Obama called on congress to close the tax loophole that allow some American companies to adopt the leaching…

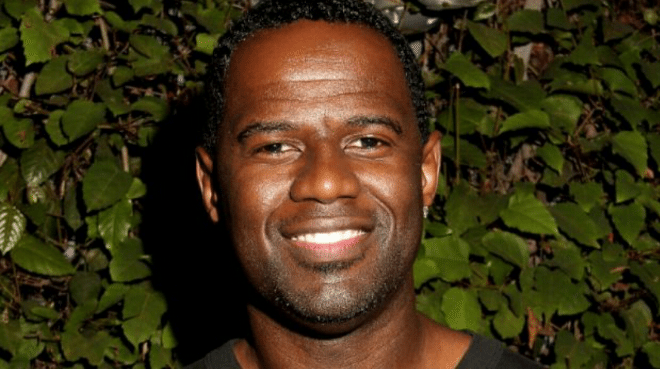

Now this one here is a shame. Clean cut R&B artist Brian McKnight, known especially for his 1997 hit "Anytime" and…

This, despised the fact that Republicans and those in the top 10 percent huddle together to convince low information Americans that…

Here's something original. Barry made over $92,000.00 filing 122 false income tax returns using the information of dead people. In other…

President Obama announced on Wednesday that the Internal Revenue Service acting commissioner Steven Miller has submitted his resignation for his agency's…

The House will mark April 15, the day federal taxes are due, by passing a bill that would require the government…

Although rich folks in America have been the only benefactors of a Republican policy called Trickle Down Economics - a policy…